PERFECTIONIST FOR E-INVOICE & E-WAYBILL

Are You Aware Of ?

Are You Seeking ?

Team Dakshabhi LLP

HERE WE COME UP WITH SOLUTION

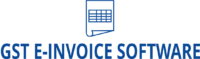

How E-Invoice & E-waybill Works ?

Generate e-Invoice from your existing software

eInvoicing is now easy to integrate! With Dakshabhi’s GSP, providing value added API, for ASPs to integrate eInvoice in Accounting / Billing / ERP System.

Also, eInvoice integration is trivial for ASPs / ERP Developers using eInvoice APIs and Free Java Library or .Net Core or .Net DLLs offered FREE by Dakshabhi.

No onboarding Charges! Free Integration support!!

Any ERP on Any Platform

Easy & Quick Integration

White labelled Panel

On-call Expert Support

We provide e-Invoicing (Electronic Invoicing) API Based Integration solution to ERP, Accounting Software and GST Compliance software.

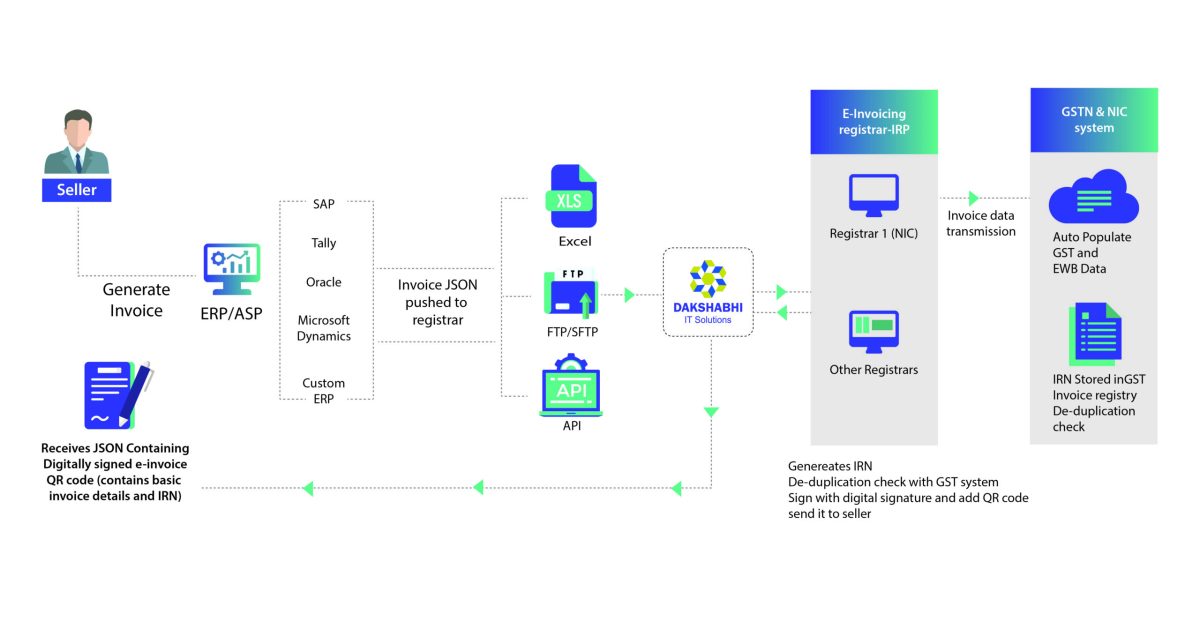

- The API-based integration with GSTN for “e-invoicing” enables the uploading of B2B invoicing documents by the supplier in the prescribed format to the Invoice Registration Portal (IRP).

- Additionally, our GSP API facilitates receipt of Invoice Reference Number (IRN) and QR Code generated by Invoice Registration Portal (IRP) after electronic authentication by GSTN for supplier uploaded electronic invoicing documents.

- If the supplier has also uploaded the transport details (via our GSP to GSTN API) along with the invoice details, then the IRP has shared these details with the E-Way Bill portal and the same E-Way invoice number will be generated.

Our Freatures

Adaptability To All Billing Requirements

This includes certificate integration, format (XML, JSON, PDF, etc.). Ensure invoices meet your customers' regional requirements & avoid rejections or delays. You can change formats, make invoices readable, upload them to the right platform via EDI or API, & add regulatory review steps as needed.

A Complete End-To-End Solution

Invoice information and real-time status confirmations make it easy to gather A/R tracking. We automate reporting and interactive web searches so you can manage every invoice you publish. We provide traceability and security from ERP to government certification and transfer to the end customer.

No Development Required

Track and manage invoices without special programming. We enable system administrators to perform all necessary documentation functions through an easy-to-use interface. If necessary, incorporate authentication steps into your current workflow.

Seamless Integration Into Processes

We automate electronic invoicing & without disrupting your existing ERP. Support accounts payable operations by streamlining incoming invoices as well. This is important in e-invoicing because it ensures that invoices can be created, transmitted, received, processed quickly & accurately.

Our Benefits

Why Choose Us...

Convenient & Easy

Easy to switch on the online invoice for any type of B2B or B2C users & customers.

One Click Contact

Single click contact for all your customers. Email & Mailbox that permit you to purchase your E-invoice.

Always Uptime

We are working 24/7 with zero downtime & use multiple GSP for fast working.

Create, Manage, Print

Perform All According to Your Needs Throughout the Functions with User-Friendly Console.

Customized Templates

Customized templates according to your brand & their preferences, choose for communication & print.

How We Work?

From Your ERP Platform

Demo. Dakshabhi

Govt. GST Server & GSTN

E-Invoicing Software Integration To Suit Your Needs

-

Web-Based

-

Desktop Application Based

-

FTP Based

-

API Based

Frequently Asked Questions?

An e-invoice is an electronic invoice that is issued, sent, and received in a structured digital format.

E-invoicing offers a number of benefits over traditional paper-based invoicing, including faster processing times, reduced errors, lower costs, and improved sustainability.

E-invoicing works by using electronic data interchange (EDI) technology to transfer invoice data between the buyer and the seller's financial systems. This can be done through various methods, such as email, web portals, or direct system-to-system integration.

The legal requirements for e-invoicing vary by country, but generally involve the use of digital signatures or other forms of authentication to ensure the authenticity and integrity of the invoice data.

Yes, there are several international standards for e-invoicing, such as the Universal Business Language (UBL) and the Electronic Business Extensible Markup Language (ebXML).

To implement e-invoicing in your business, you will need to evaluate your existing invoicing processes and systems, choose an e-invoicing solution that meets your needs, and train your staff on how to use the new system.

Yes, e-invoicing is generally considered to be secure, as it uses encryption and other security measures to protect the confidentiality and integrity of the invoice data. However, it is important to choose a reputable e-invoicing solution provider and follow best practices for data security.

The cost savings associated with e-invoicing can vary depending on the size and complexity of your business, but can include savings on printing, postage, and processing costs, as well as reduced errors and disputes. Some studies have estimated that e-invoicing can save businesses up to 80% on processing costs compared to traditional paper-based invoicing.

Testimonials

Add testimonial description here. Edit and place your own text.

John Doe

Codetic

Add testimonial description here. Edit and place your own text.

John Doe

Codetic

Add testimonial description here. Edit and place your own text.

John Doe

Codetic

Add testimonial description here. Edit and place your own text.

John Doe

Codetic