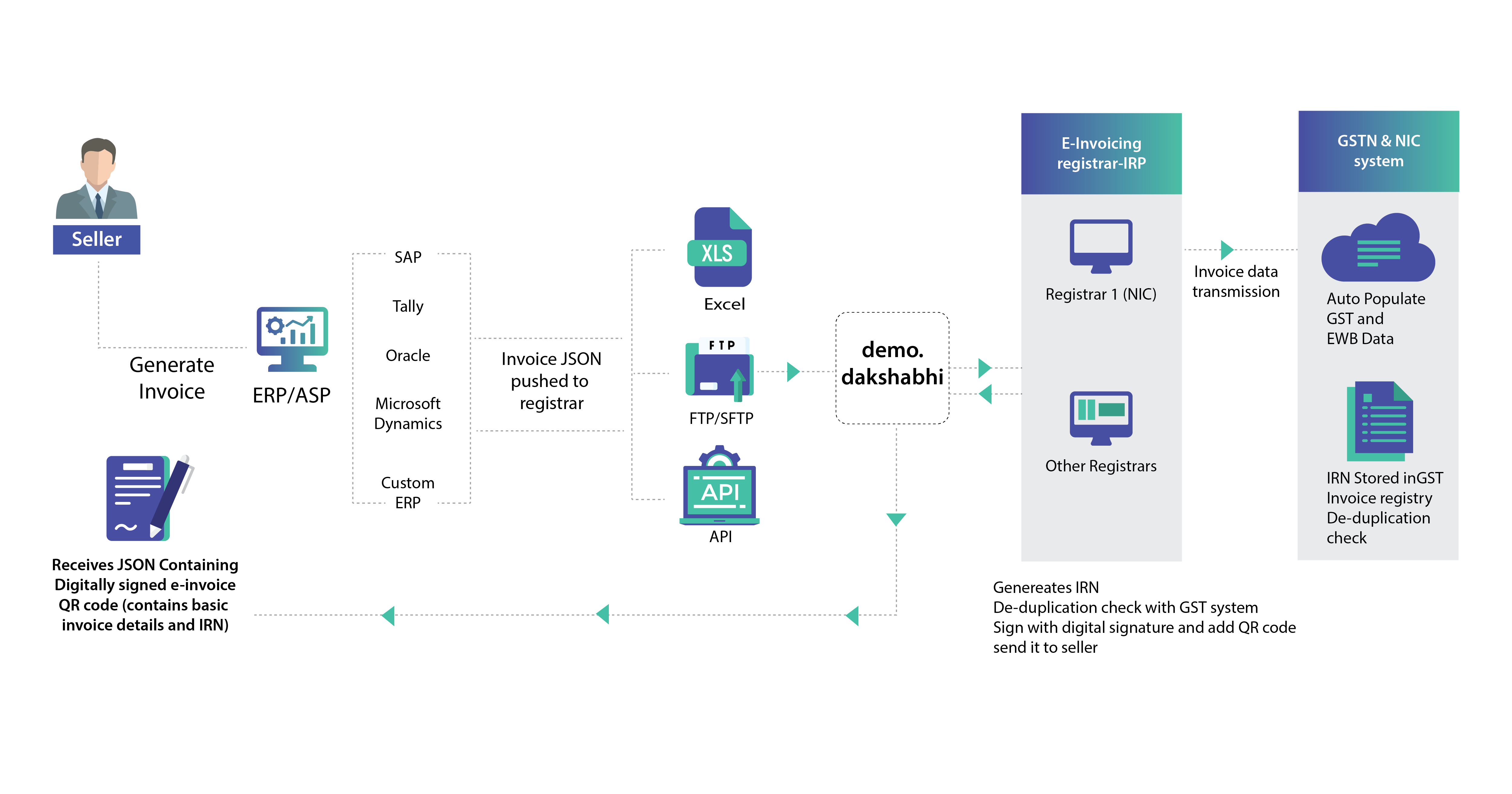

How E Invoice Software Work for GST ?

e-invoicing software for GST simplifies the invoicing process and ensures compliance with GST regulations, while also improving efficiency and accuracy.

Invoice creation

The e-invoicing software creates the invoice in a specified format, which includes mandatory fields such as the supplier's GSTIN, the buyer's GSTIN, invoice number, date, and item details.

Invoice validation

The software validates the invoice against GST rules, such as matching the invoice details with the supplier's GST return and the buyer's input tax credit claims.

Invoice authentication

The invoice is authenticated with a unique invoice reference number (IRN), a QR code, and a digital signature from the GST Network (GSTN).

Invoice reporting

The software reports the invoice details to the GSTN in real-time, which updates the supplier's and buyer's GST returns.

Invoice archiving

The software archives the invoice electronically for future reference and audit purposes.

Automated reminders

Automated reminders can help you stay on top of unpaid invoices, reducing the risk of late payments and improving cash flow.

Advanced Features To Make Your e-invoicing process simple & smooth

☞ Automated data capture:

This feature automatically captures invoice data and populates it into the system, reducing manual data entry errors and increasing efficiency.

☞ Customizable templates:

Customizable templates allow you to create your own invoice designs, which can help you stand out and promote your brand.

☞ Integration with accounting software:

Integrating your e-invoicing system with your accounting software can streamline the invoicing process and eliminate the need for manual data entry.

☞ Electronic signatures:

Electronic signatures can provide a secure and legally binding way to sign and authorize invoices.

☞ Multi-language and multi-currency support:

If you do business with clients in different countries, having support for multiple languages and currencies can make invoicing simpler and more efficient.

☞ Real-time tracking and reporting:

Real-time tracking and reporting can help you keep track of your invoicing process, from creation to payment, and provide valuable insights for optimizing your invoicing process.

Benefits of e-invoicing for Indian businesses

Compliance

E-invoicing software ensures that businesses comply with the GST regulations, including invoice format, mandatory fields, and invoice numbering requirements.

Faster processing

E-invoicing software enables faster invoice processing, which results in faster payments, improved cash flow, and increased efficiency.

Reduced errors

E-invoicing software eliminates errors and discrepancies related to manual data entry, reducing the risk of disputes and incorrect tax filings.

Improved accuracy

E-invoicing software ensures that invoices are accurate, complete, and in compliance with GST rules, reducing the risk of penalties and fines.

Seamless integration

E-invoicing software can be integrated with accounting and ERP systems, enabling automated processing and seamless data transfer.

Reduced operational

E-invoicing software reduces the cost of paper, printing, and postage, resulting in significant cost savings for businesses.